Treating Customers Fairly

The essence of all we do is based on love and care. With fair, compassionate services, we ensure customers are treated with the same consideration we would give ourselves. We attach particular importance to the rights and interests the underprivileged, elderly, or new immigrants, aiming to exceed customer expectations by providing more high-quality, innovative, diversified services for policyholders.

Fraud has become rampant in Taiwan recently and tricks used by scam groups are evolving. With the promise of safeguarding the assets of our customers in mind, we have put in place three actions plans, identifying fraud via awareness campaigns, preventing fraud via reminders, and intercepting fraud via first line of defense, to proactively help customers combat fraud. Furthermore, a designated fraud prevention page was launched to raise policyholders’ awareness and teach them how to identify fraud. The goal is to safeguard customers’ happiness.

Taiwan has become a super-aged society and, with that, comes the challenge of dementia. As the first “dementia-friendly lifer” in the industry, we have collaborated with the Taiwan Alzheimer Disease Association to develop key chains with emergency contact cards for people with dementia. These key chains were distributed at six major customer service centers and can be provided to policyholders in need. Furthermore, a designated page was established on the Company’s official website to share health tips on dementia prevention with policyholders, forming a care network for the elderly with dementia.

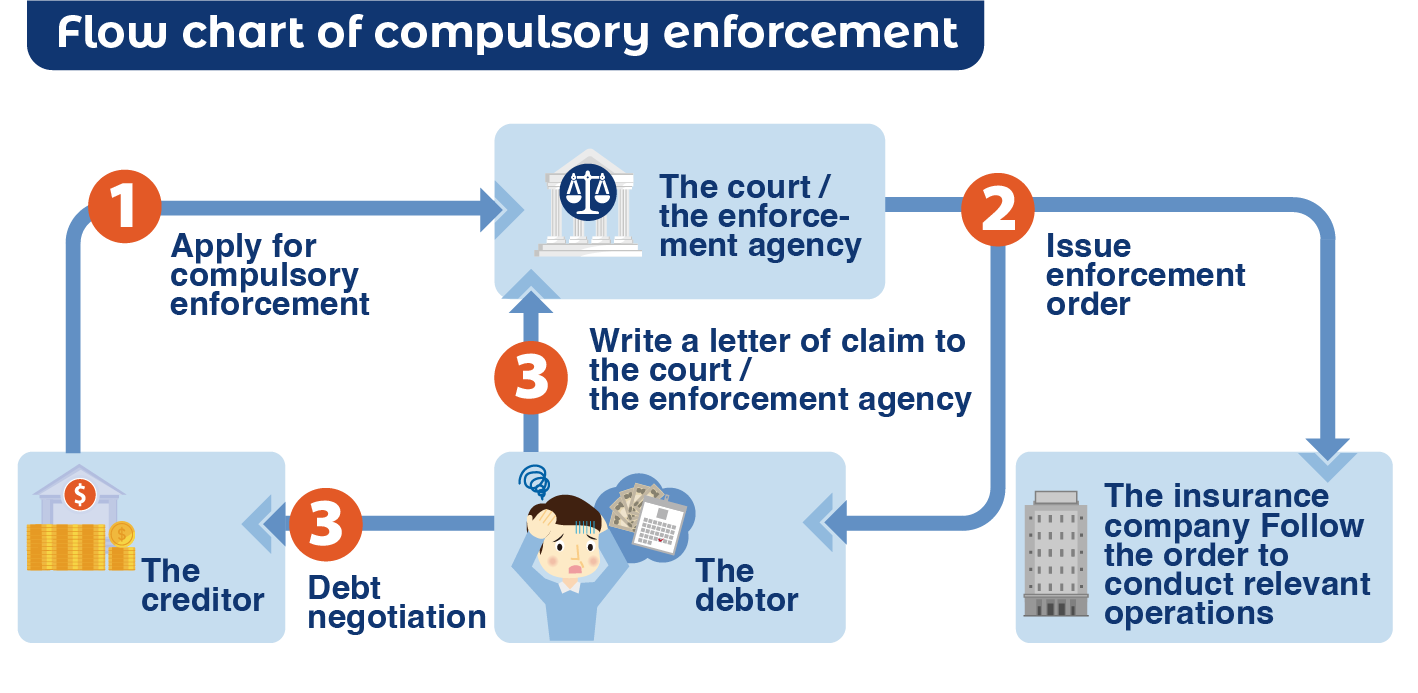

According to the law, if the debtor is unable to repay his/her debt, or pay tax/penalty, the creditor or the national institution can apply for a warrant to seize the debtor’s property to the Civil Enforcement Department or the Administrative Enforcement Agency. We provide policyholders with relevant description. For more details, please go to the “Policy Compulsory Enforcement” page.

We value our communication with policyholders and have long sent monthly e-newsletter to policyholders. The topics of e-newsletter include health tips, news for policyholders, trending topics, personal finance tips, and heartwarming stories. Through monthly newsletter, policyholders can acquire information in a convenient, efficient, and eco-friendly way.

In response to an aging population, the Company has been working with regional clinics and hospitals to direct policyholders to go to the nearest place for quality and integrated healthcare services catered to their needs.

The Company has long worked with Koo Foundation Sun Yat-Sen Cancer Center to provide second opinion medical service to policyholders, who have been allegedly diagnosed with cancer, to confirm diagnosis and provide treatment suggestions.

In the past, after being discharged from the hospital, policyholders had to prepare medical receipts and hospital diagnosis before applying for claim. We value the needs of our policyholders. In consideration of bills incurred during hospitalization, we continue providing advanced claim payment service. Policyholders who are qualified can apply for this service once they are admitted to the hospital. After review, policyholders can receive up to NT$60,000 advanced payment.

Fast claims services for those who are deceased or injured because of wind disasters or other major catastrophes. Once the accident is deemed covered by the insurance, the Company will proactively prioritize benefit payment before beneficiary applying for claims.

We deeply feel the urgency that policyholders feel during emergency and crisis. KGIL is always there when policyholders need us and therefore fast claims service was launched at six major customer service centers across Taiwan. If the general medical insurance has been effective or reinstated for two years or above and the amount of claim payment is within NT$30,000, with required documents prepared, policyholder can apply for claims at the counter and claim review will be completed within 30 minutes, allowing policyholders to receive payment within one day. Furthermore, if policyholders’ deposit bank supports eACH service, they can receive transfer within 30 seconds after the case is closed, demonstrating that the function and value of life insurance are to help our customers to pull through the difficulties. For us, claims are more than just a financial obligation but a heartwarming care and services.

We provide fast claims services, advanced payment for hospitalization, premium deferment, discount for policy loan, mortgage relief, and flexible adjustment of travel insurance, helping policyholders to sail through difficult times.

If policyholder is in areas outside of Taiwan, Penghu, Kinmen, or Matsu and is in of emergency assistance, he/she can phone overseas emergency assistance organization for immediate services.