Treating Customers Fairly

Introduction

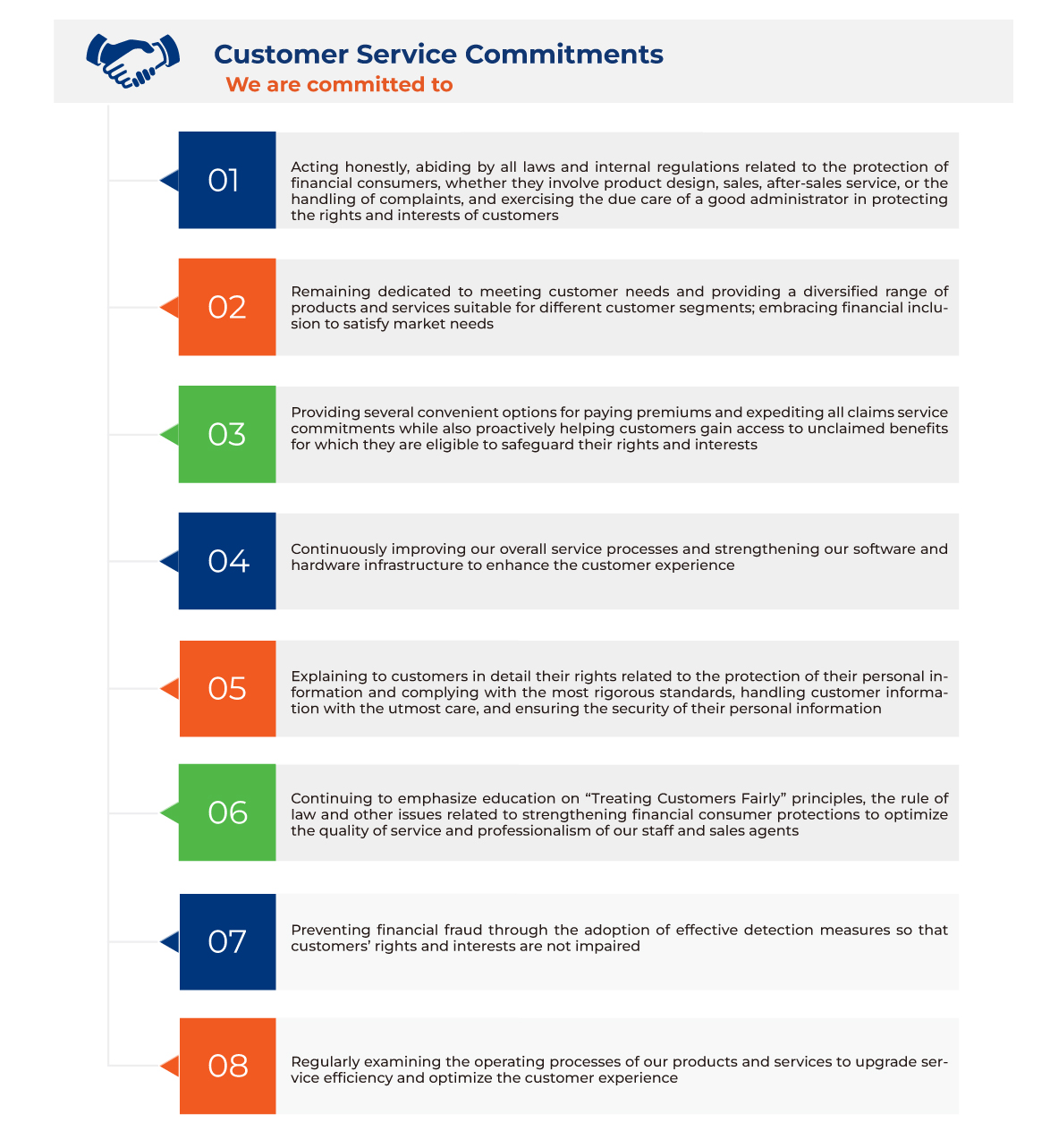

KGI Life aspires to forge a corporate culture in which every employee treats customers fairly with a caring attitude and a service mindset focused on fairness and empathy. That commitment extends to understanding and caring for vulnerable customers and creating ever better services for all financial consumers so that their rights and interests are fully protected.

Customer Service Commitments

|

Customer Service |

Our Service Commitments |

|---|---|

|

Policyholder Services |

|

|

Policyholder Interests |

|

|

Claims Services |

|

|

Customer Service Center Counter Services |

|

|

Toll-free Customer Service Hotline |

|

|

Home Delivery of Documents |

|

|

Website Message, Service Mailbox |

|

|

Complaint Handling |

|

1.We are committed to providing customers with the most accurate information in real time, whether related to descriptions of policies or new contracts or after-sales service.

2.Customers can choose from among a wide range of communication channels to obtain information or get timely service.

3.The information we provide is clear, transparent, and accurate, and enables customers to get appropriate notifications before, during, and after a sale is made.

4.We always listen to the voices of our customers, and adjust and improve our products and services based on feedback obtained in regular customer surveys.

5.We provide diverse channels through which complaints can be made, and a sound process and mechanism for handling complaints is in place. Complaints are reviewed in a timely manner fairly and objectively, and we try to find solutions from the customer’s viewpoint. If the outcome of the process falls short of the customer’s expectations, the customer can file an appeal with the Financial Ombudsman Institution.

1.KGI Life’s board of directors has established a “Treating Customers Fairly Committee” to ensure that the company’s products and services encompass and reflect Treating Customers Fairly (TCF) principles. The committee is responsible for helping the board promote TCF-related initiatives. At the same time, the TCF principles are being internalized into a core value of KGI Life through a “plan-do-monitor-optimize” cycle.

2.We have established a “Treating Customers Fairly Policy and Strategy” and “Treating Customers Fairly Implementation Rules” to be followed in our operations. They ensure that financial consumers are treated fairly and reasonably at every stage of the process in financial product and service transactions.

3.We closely follow ten Treating Customers Fairly principles, as follows, to protect financial consumers and fulfill our corporate social responsibility:

-

principle of contract fairness and good faith

Contracts for financial products and services established with consumers shall be based on the principles of fairness, reasonableness, equality, reciprocity, and good faith

-

principle of duty of care and loyalty

When providing goods or services to financial consumers, the due care of a good administrator should be exercised, and, depending on the nature of the product or service, the duty of loyalty shall be borne in line with applicable laws and regulations or contractual agreements

-

principle of truth in advertising and solicitation

When advertising, soliciting consumers, or conducting promotional activities, the company shall not spread falsehoods or engage in deception, concealment, or any other activity that may mislead another party and it shall ensure that the advertising content is true

-

principle of product or service suitability

Before entering into a contract with a financial consumer for a product or service, the company shall fully understand the customer’s background to be sure that the product or service being sold is suitable for that customer

-

principle of informing the customer and disclosing key information

Before a financial consumer enters into a contract for a product or service, the company shall use an appropriate method that the consumer can understand to explain and disclose important aspects and risks of the transaction being considered. If it involves the collection, processing and usage of personal information, the consumer shall be made fully aware of their rights related to personal information and the possible disadvantages of refusing to agree to the use of that information

-

principle of a balance between remuneration and performance

When considering the remuneration system for sales people, the company should balance various factors, such as financial consumer rights, the risks that could be generated by the product or service being sold, the quality of solicitation, sales performance, and the timing of bonus payments

-

principle of protecting the right to file a complaint

Procedures for handling customer complaints shall be established, and financial consumer complaints shall be actively handled based on those procedures

-

principle of professionalism of sales people

Sales people shall have applicable qualifications required by law and undergo related training at regular intervals

-

principle of friendly service

At all stages of providing goods and services, the company shall take into account the needs of the elderly, vulnerable and disabled groups; provide friendly services and ensure fair treatment of customers

-

principle of implementing ethical management

The company shall drive corporate culture of ethical management from the top ; implement relevant measures and establish an effective internal control mechanism to prevent unethical behaviors

4. We encourage all employees who deal with customers, whether in an office or in the field, to share customers’ stories and relay their needs as well as suggest improvements and ways to optimize the customer experience. Having all of our people work together can help us fulfill our commitments to customers.

Financial Inclusion Measures

- We comply with the United Nations “Convention on the Rights of Persons with Disabilities” in respecting and supporting people with disabilities and safeguarding their rights and interests as financial consumers.

- We refer to the “Guidance for firms on the fair treatment of vulnerable customers” issued by the United Kingdom’s financial regulator, the Financial Conduct Authority, in caring for the needs of vulnerable customers, including those with disabilities. That covers designing products and services that guarantee that these customers experience outcomes as good as those for other customers.

- We strive to understand the needs of vulnerable customers, including those with disabilities, and make available appropriate communication channels and service approaches to uphold their rights and interests as financial consumers.

- We provide accessible facilities and a friendly branch environment, and provide intensive training to all employees to strengthen and refine the service offered to vulnerable customers, including those with disabilities.

- We carry out financial inclusion initiatives and incorporate service guidelines and special precautions for vulnerable customers, including those with disabilities, into employee training and related internal regulations.

- In support of customers who cannot conveniently use our regular website, we have established a special accessible webpage to empower them to understand their rights and interests as financial consumers and obtain insurance services that meet their needs.

- We have set up a toll-free friendly finance hotline that is staffed by representatives specially trained to serve vulnerable customers, including those with disabilities.

- We have joined a dementia-friendly community under the auspices of the Taiwan Alzheimer Disease Association. Through that initiative, we encourage our employees, including those working at our six major customer service centers and call centers, to complete dementia-related training, and have also mobilized all local offices around Taiwan to participate. As a dementia-friendly insurance company, we take the initiative in providing the most appropriate services to policyholders and their dependents.